How can Dozens help me save?

So, our high interest rates and long term investments can ensure your savings are working hard. But what if you don’t have savings yet? How can Dozens help you take the first step towards a better financial future? Here we explain our approach to saving, and the tools we’ve developed to help anyone become a saver.

We think it’s fair to say the majority of people would like to save money. Whether for something special like a holiday, a longer term plan like a deposit on a house, or simply as a safety net should your financial circumstances suddenly change.

The problem is, even with the best of intentions it’s very easy to lose track of things and at the end of the month realise you’ve spent quicker than you intended, leaving you with nothing left to save or even dropping into overdraft.

Spending money is a very different experience from what it used to be. The entire high street is available on your phone meaning you can click ‘buy’ without a second thought. Contactless payments have made transactions ‘friction free’, so you don’t feel the money come out of your wallet. And now with smart watches, all you need is a flick of the wrist and *poof*… the money is gone.

So, while there’s been great innovation relating to spending there’s been nothing for saving. And with a quarter of people in the UK struggling to save money, we think it’s time that changed. At the beginning of 2018, we set out to create the best savings tools possible.

We brought together a cross section of expertise. Obviously, we have some cracking financial experts on our team but 75% of us are from non-financial backgrounds. This ensures we get a variety of perspectives. For example, we have a psychologist looking at spending triggers, an urban designer looking at how people move around cities and a data scientist working with a graphic designer on how to visualise spending.

We were also hugely inspired by the community we worked with in the early stages. Hundreds of people across the UK got involved, sharing their thoughts on spending and saving, and informing our ideas.

Anyway, enough of the backstory. ‘Show us the money’ as it were. Here are the saving innovations you will find in the Dozens app:

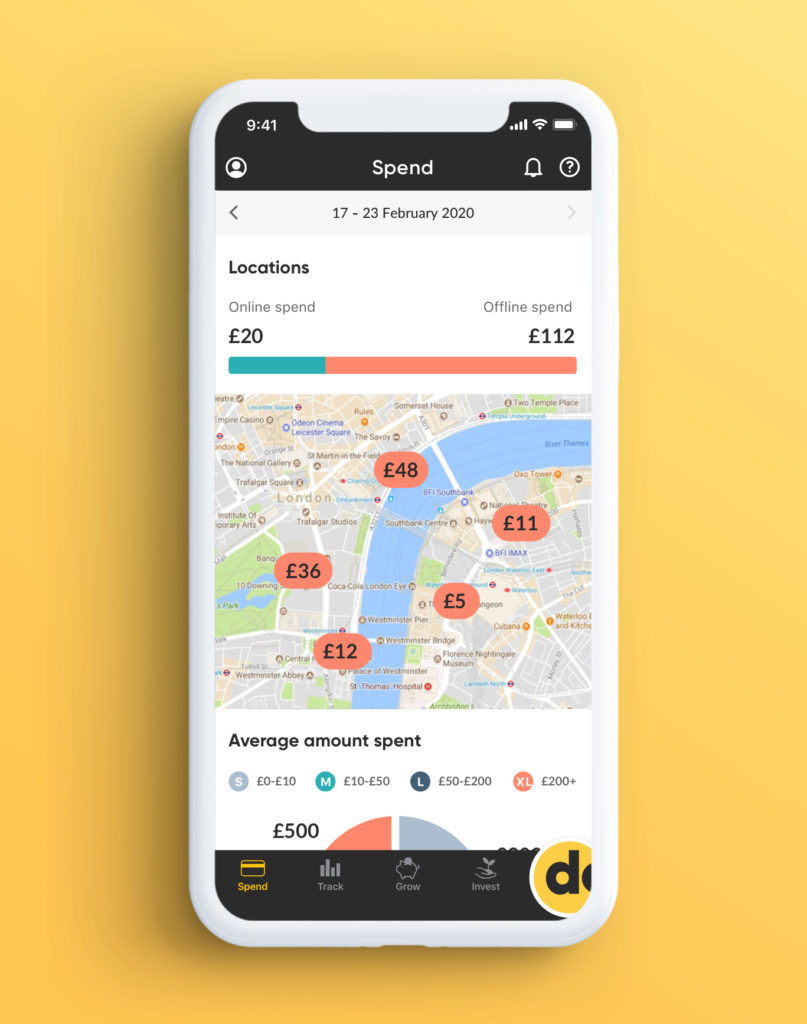

Visual Spend Reports

Card statements needed an overhaul. Current Account providers are required to present you with a chronological list of transactions. But how much work is being done to make these actually understandable?

Our Visual Spend Reports use the data behind your transactions to visualise your spending and make it easier for you to see patterns and know where you could save money.

Some of the many visual reports provided in the app:

- On a map – easily see where you’re spending, or how much you spent on holiday.

- By category – easily see where you’re spending, or how much you spent on holiday.

- By transaction size (s,m,l,xl) – are small purchases actually your biggest spend?

- By retailer – Tesco? ASOS?

- On a heatmap – 3am on Thursday was the killer.

- By how it made you feel – What was most worth it? (nb. this doesn’t use existing data, but uses the happiness ratings you give your transactions. See below for more info.

Please rest assured we do not gather any ‘new’ data from your spending for this feature. Everything we use comes from the transaction data and is available to any debit card issuer. We simply make it available for your benefit, to help you get a better sense of where, when and how you spend.

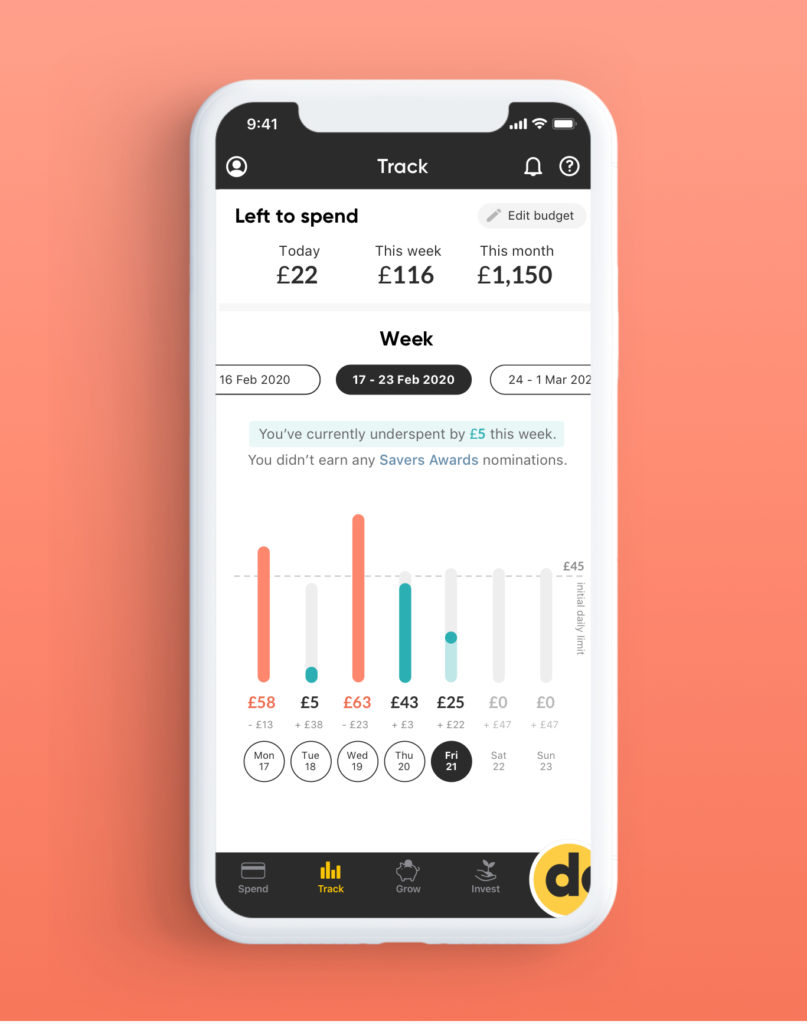

Our Smart Budgeter

One thing we’ve heard over and over again, was that it’s really hard to balance spending across a month. Even with the best of intentions many of us find ourselves drifting into overdraft to tie us over until payday (which is an incredibly costly way of borrowing money). We discovered people find it a lot easier to budget across a week.

To set up Smart Budgeter simply provide a few details of your income and bills. The Budgeter will calculate your discretionary spend – this is what you have left to play with on a day to day basis. Then the discretionary spend is then broken down into weeks, and days.

Every day the Smart Budgeter gives a suggested max spend.

As you spend across the week, that suggested max spend changes to take into account your previous day’s spending.

This means, if you go over budget one day, it’s not a big deal, simply stick to the lower amount the next few days you can still come out on budget at the end of the week.

Use the Smart Budgeter each week and before you know it, you’ll be on track for the month, and the year.

Plus, our Smart Budgeter will soon be a way to gain nominations for our Savers’ Awards, for a chance of winning £100 cash. We’ll be announcing details soon!

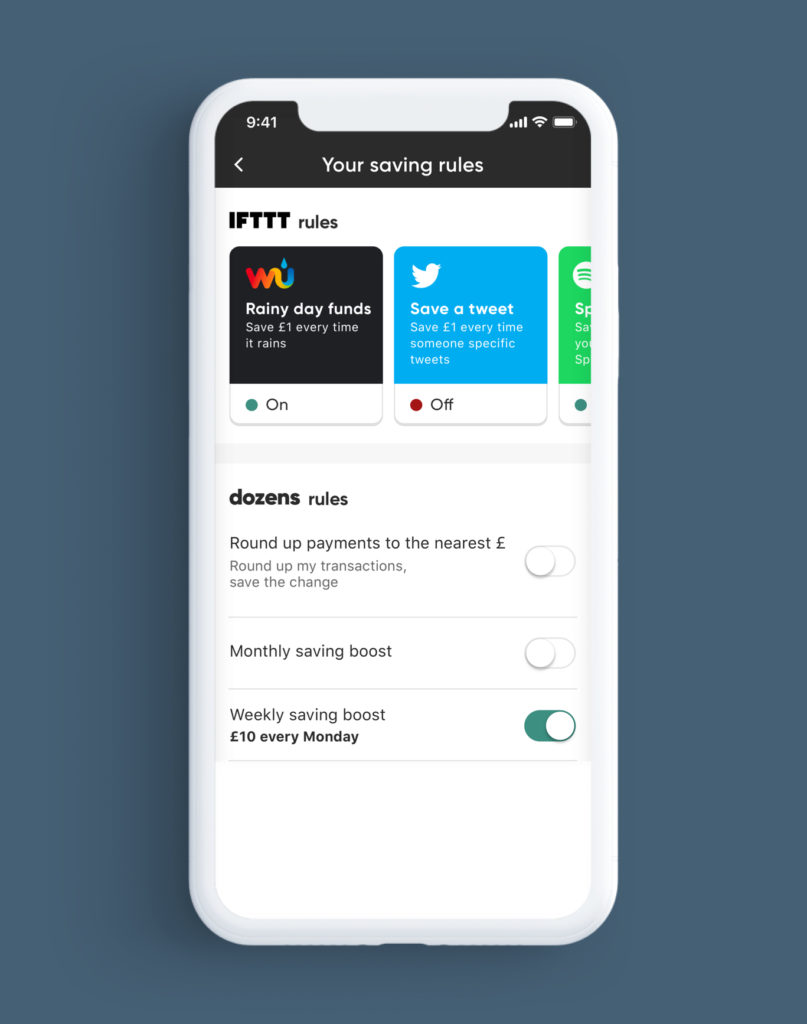

Saving Rules

What if saving just happened? It’s not a chore, it’s just something that’s built into your everyday life. Money automatically moves from your current account into your cash savings because, well, perhaps you’ve just been paid, or you turned the heating down, or maybe just because your favourite celeb tweeted?

Switch on one of our Saving Rules and money will automatically move from your Current Account to your Cash Savings whenever something specific happens.

Saving rules can be used for different things:

Rules that are regular

- roundups – This will round up every transaction to the nearest pound and move that change into your cash savings.

- monthly/weekly – This will move a set amount of money into your cash savings at particular intervals

Rules that recognise when you’ve been good

- These are rules that recognise when you have done something that has saved you money. For example, our ‘Hot saving’ rule will put some money aside every time you let your home temperature drop below 20°C. So, you get positively rewarded for turning the heating down and see your savings going up.

Rules that encourage good habits

- Or perhaps there’s another good habit in your life you want to instil? Why not use the ‘Fit Saver’ rule and save some money every time you achieve your calorie goals on Fitbit? Or perhaps setup the ‘Location Saver’ to save money every time you visit your gym (or even ‘tax’ yourself by saving when you visit the local takeaway!)

Rules that are just for fun

- Saving doesn’t need to be all about routines and predictability. Our savings rules can add an element of excitement. For example, “Rainy day funds” will save a pound each time it rains in London, so the drizzly days could save towards some time in the sun. Or ‘Save a tweet’ could save every time your fave celeb tweets.

To enable these rules we’ve partnered with IFTTT – a service that uses ‘applets’ to connect different areas of your life. For most of the rules you will need to create an IFTTT account (IFTTT have absolutely no access to your financial data). For Roundups and monthly/weekly savings no IFTTT account is required. Saving Rules can be found in the save section.

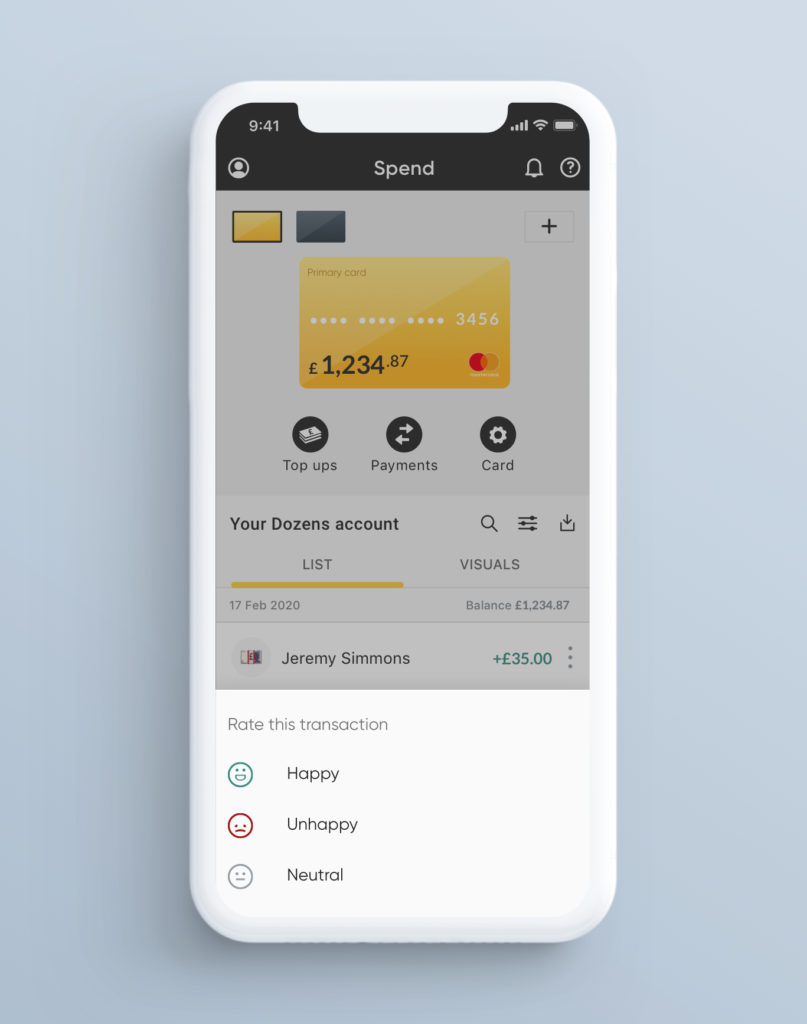

Happiness Ratings

Happiness ratings are a feature designed to get us all engaging with our spending again.

Let’s face it, no one else can tell you what you should or shouldn’t be spending money on. What one person may think is an extravagance, another person may think is an absolute essential. Happiness ratings help you evaluate what is really important to you.

In the Spend section, each transaction can be rated as ‘Happy’, ‘Unhappy’ or ‘Neutral’. Later, if you need to cut down on spending, look back at your unhappy spends – they’re likely to be the best place to start.

The Savers Awards

The Savers Awards encourage and reward positive financial habits.

Throughout the month, certain things you do within your Dozens app – the positive financial behaviours – will get you nominations for our Savers Awards. At the end of each month there will be a prize draw where we will give out cash prizes of £100.

Why? Well, it’s our way of giving cashback for saving rather than spending.

Your Savers Awards nominations can be found in your Profile. For more details of how you get nominations read our post here.

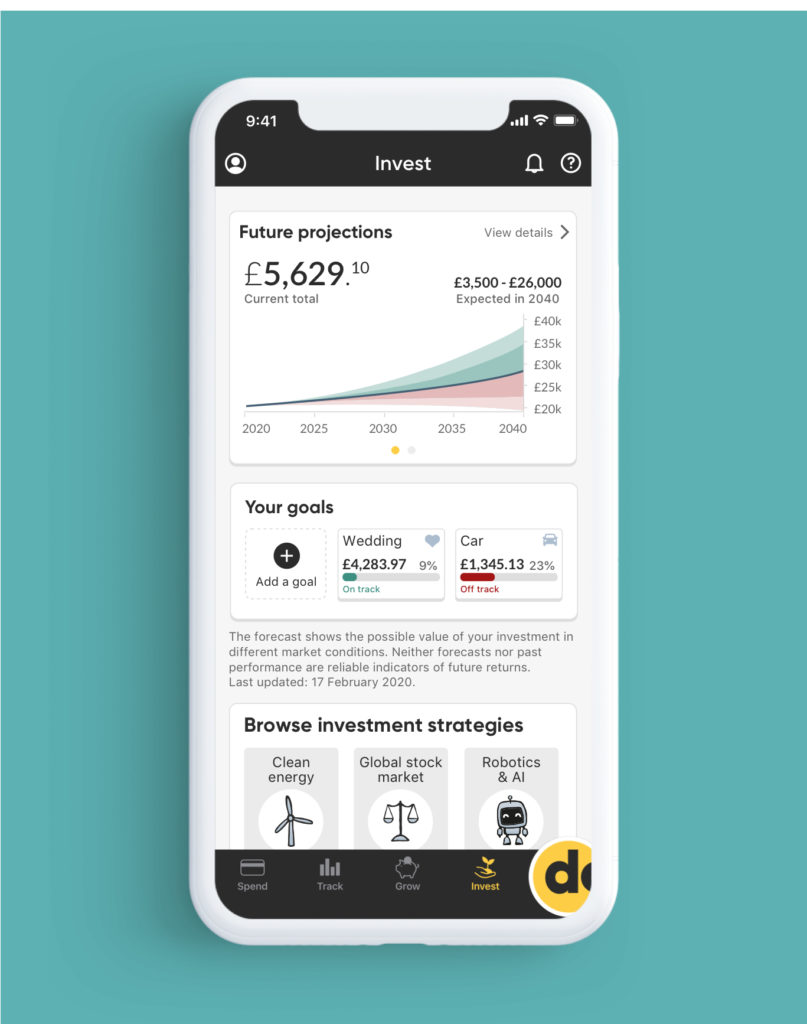

And finally… The Financial Products

We knew it was important that while we were helping you save, we also needed to ensure your savings grew at a decent rate. And in our opinion, interest rates on easy access, low risk savings products have not been ‘decent’ for a very long while. We knew something new was needed. This is where Dozens Savings Plc’s listed 5% p.a. Fixed Interest Bonds came in. The 12 month bonds were designed to give anyone with £100 access to the kind of interest rates normally reserved for people with large chunks of money or high risk appetite. In early 2022, we closed the bond programme to allow us to work on some exciting new plans including a new 1% product that will allow us to bring returns to more people. More info here.

We also have our thematic investment portfolios, which make long term investment and managed risk understandable and accessible.

These are just the first of many financial solutions we have in the pipeline to help you grow financially.

So, there you have it. These are the features we’ve built into the Dozens app to help you save. What do you think? We’d love to hear your reactions. Let us know on our social channels (links at the bottom of the page) or give us a shout on our community.

If you’re not yet a dozens customer, you can enjoy all these tools by signing up for an account through our app. Download the dozens app here:

Dozens is not a bank. Dozens is a trading name of Project Imagine Limited which is a company authorised by the Financial Conduct Authority (FCA) as an e-money institution (FRN 900894) and also as an investment firm (FRN 814281).

Bonds are not FCA regulated products, and FSCS protection does not cover the bonds. Dozens’ Fixed Interest Bonds bonds are allocated, issued and administered by Dozens Savings Plc. The interest offered by Dozens’ Fixed Interest Bonds will not fluctuate even in different market conditions. All of your money to be invested, plus the full 12-months interest, will be placed in a separate trustee-controlled account on your behalf. This would be used to pay you in the event of any default. The bond programme currently has a maximum limit of £7m, with expected issuance volumes of between £100k-£1m a month.