Dozens Savings Plc’s listed 5% p.a. Fixed Interest Bonds – Everything you want to know

April 2022 update: From 2019 to 2021, over £3.6m worth of bonds were issued helping savers across the UK get a better return for their money. The bonds programme has now closed to allow us to reuse this budget and experience to bring you even newer financial products. More info here: https://www.dozens.com/no-new-bonds/

5%… Sounds too good to be true, right?

When you first hear it, it sounds impossible. It’s understandable to feel that way. Since 2008 interest rates in the UK have been stuck at historic lows. In fact, if you’re under thirty years old, it’s likely you’ve never known interest rates over 1%.

There was a time however, not so long ago, when 5% p.a. used to be the accepted ‘risk-free rate’, i.e. you could buy some of the safest bonds, like the US Government’s Treasuries, at 5%. So, as part of our mission to help everyone make the most of their money we set out to provide access to financial products that make high interest more accessible.

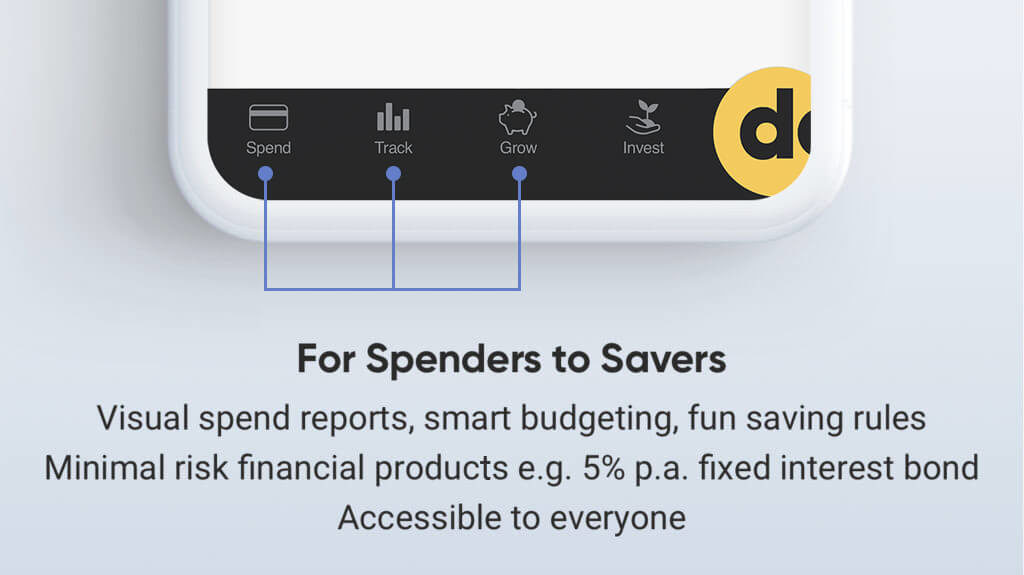

At Dozens, we’re always thinking about two types of people – those struggling to save (people on the journey from Spender to Saver), and those who already have a chunk of savings but are looking for the best options for it (people on the journey from Saver to Investor). Within the app structure, the Grow section, along with Track, is the one that tries to help people put money aside through the use of budgeting, smart rules such as ‘save for a holiday every time it rains in London’, etc.

This is also the section where we want to reward people once they have managed to save. If in future we are able to become a bank, we could do this through FSCS protected savings accounts where, in a challenge to the banking status quo, we would pass on the majority of the earnings from people’s savings back to them. But as we are not a bank, we have had to think innovatively about how to incentivise a new generation of savers in the meantime – without exposing them to risk.

As soon as the word ‘risk’ is shown alongside a financial product, it becomes an immediate barrier for many (and quite rightly so for early stage savers). To address this entry barrier, we wanted a product that was risk-free, liquid and offered high interest – almost like a cash back for not spending, rather than for the opposite as most other financial service providers seem to offer.

Dozens Savings Plc's 5% p.a. Fixed Interest Bonds

Found in the ‘Grow’ section of our app, these bonds are a proprietary financial product of Dozens Savings Plc and are designed to bear no risk to capital. When bonds are purchased, money invested plus the promised interest, is deposited into a separate trustee controlled account (which cannot be touched). The bonds are not regulated by the FCA.

How is this possible? By simply treating the 5% as a cost of building an entire offering around savers. Why? Belief in the importance of having a high interest product for people who are just starting to save and experience interest, which is why we’re willing to fund this product from the revenues earned from our other products.

What are the details of Dozens Savings Plc’s 5% p.a. Fixed Interest Bonds?

The 5% p.a. Fixed Interest Bonds last 12 months and the interest is paid monthly. As the interest rate is fixed, it will not fluctuate in different market conditions.

With these bonds you can start earning interest with as little as £100 by buying one bond. And anything above that needs to be a multiple of £100.

- Should you wish to take your money out before the 12 months are up, you can sell your bonds at any time. You will receive all your money back, and the interest you’ve already been paid won’t be affected. For example, if you bought £1000 of bonds on 1 January and on 15 April you need the money, you can sell back your bonds, get all your money back and keep the interest from Jan to March that you’ve already been paid. You won’t receive interest for April, as you did not complete the whole month, or any remaining months connected to that issuance.

For logistical reasons, you’ll need to sell back all of your bonds from a single issuance (rather than a portion of what you purchased). For example, during that bond issuance you purchased 10 bonds – £1000 worth – but now you need £200. You cannot just sell 2 bonds, you must sell all 10 bonds at once.

- At the moment there is no maximum for how many bonds you can buy, however the bidding system in place prioritises smaller amounts.

We have earmarked funds for issuing at least £7m of Fixed Interest Bonds in issuances of £100k–£1m. We cannot sell more than we have each time. These bonds have been designed to give early stage savers the option of purchasing a higher return financial product in which their capital is not at risk. The bidding system was put in place as a means of ensuring the 5% fixed interest and accompanying protection could be enjoyed by as many people as possible.

In the Grow section of the app tap ‘Add a bond’, then follow the bidding process, stating the amount you’d like to buy. It only takes a few minutes. You can place one bid for each issuance. You have until the bid closing date to bid. You can change the amount at any time until then.

When bids are closed, Dozens Savings Plc ranks all bids by size, with the smaller amounts taking priority. For two or more bids of the same value, the bid that came in first will be of higher priority. The bonds are issued in the above order of prioritisation until the issuance limit is reached (details below). This is the cut off point, bids beyond this will be unsuccessful.

So what this means is that you, as customers, set the maximum amounts i.e. for a £100,000 issuance, if you subscribed for the full £100,000 and there were no other subscriptions, your bid would be successful.

The bonds are allocated, issued and administered by Dozens Savings Plc. On issuance, the bonds are listed on the Aquis Stock Exchange and have proper documentation governing their sale.

- They are ISA eligible. When setting up, you have the option to choose between an ISA (stocks & shares) or a General Investment Account (GIA). You can open a new ISA if you haven’t already opened a stocks & shares ISA with another provider in the same tax year.

Note that neither Dozens or Dozens Savings Plc cannot provide you with tax advice, as everyone’s tax status is unique to them and depends upon your individual circumstances. Please also note that your tax status and tax treatment of products may change over time.

Why has no one else done any of this before?

Good question.

Well, there’s the fact that financial institutions can be very traditional with rigid product silos that make it extremely hard to innovate financially. Even the newer fintechs, while they are able to innovate on the tech, are still not motivated enough to solve the financial problem. Whether old or new, they are all relying on your debt for their profit. So they tend to innovate on things to do with spending and credit rather than saving.

And to be honest – it’s bloody hard. It’s taken an incredible amount of hard work from the team and is not something a business would do unless it truly cared about financial equitability and innovation.

Why do we do it? Because financial institutions make a huge amount of money from your deposits, and we think it’s time you were offered a fair return.

If you’re interested in knowing more about the current financial system and what we think needs to change, check out our #Questionyourbank series.

So how do I buy bonds?

They can be found in the Grow section of the app. Download the app and complete the signup process to open your Dozens account.

You may also want to check out this blog post that tells you what to expect from the sign up process.

You may also want to check out this blog post that tells you what to expect from the sign up process.

There must be a catch, somewhere in the smallprint?

Nope. No smallprint. Everything is here.

Please do shout if you have any niggling queries. Not only will we be happy to help but it will help us make this article the most informative it can be.

@wearedozens on twitter, instagram or facebook.

Email help@dozens.com

Or chat to us and other Dozens customers over in our community.

Article amended 16 July 2020 — to provide clarity between ‘Dozens’ – the app, and Dozens Savings Plc the provider of the listed 5% p.a. Fixed Interest Bonds

Article amended 28 January 2019 — Detail added on the difference between Trust bonds and EM bonds.

Article amended 20 March 2019 – Detailed added about bond protection.

Article amended 25 July 2019 – Detail of EM bonds removed so as to focus post on 5% p.a. Fixed Interest Bonds

Dozens is not a bank. Dozens is a trading name of Project Imagine Limited which is a company authorised by the Financial Conduct Authority (FCA) as an e-money institution (FRN 900894) and also as an investment firm (FRN 814281).

Bonds are not FCA regulated products, and FSCS protection does not cover the bonds. Dozens’ Fixed Interest Bonds are allocated, issued and administered by Dozens Savings Plc. The interest offered by Dozens’ fixed interest bonds will not fluctuate even in different market conditions. All of your money to be invested, plus the full 12-months interest, will be placed in a separate trustee-controlled account on your behalf. This would be used to pay you in the event of any default. The bond programme currently has a maximum limit of £7m, with expected issuance volumes of between £100k-£1m a month.