New research from Dozens, Seedrs and YouGov has found a gap in financial awareness and advice across the UK

A recent study by Dozens, Seedrs and YouGov set out to investigate the financial gap in the UK. The study found that there seems to be a significant gap in the UK in advice and guidance for helping people plan their financial futures.

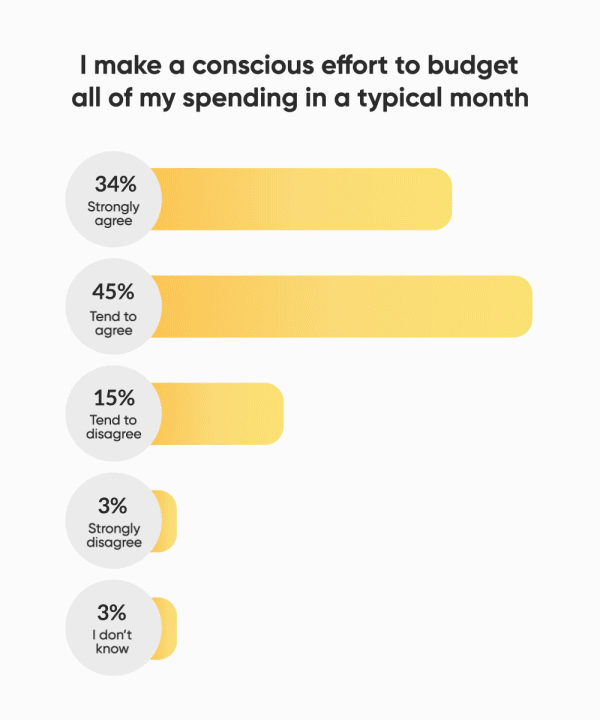

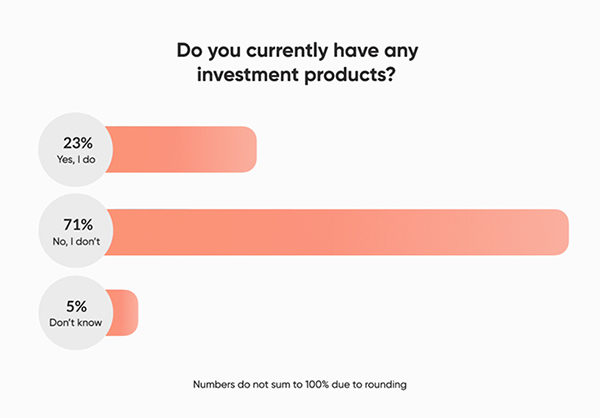

Although 79% of UK adults are making a conscious effort to budget in every typical month, 47% of those with a savings account said that they don’t know what interest rate their savings account offers; suggesting they aren’t getting the most out of their savings, and 71% have no investment products (e.g. stocks and shares or bonds).

When it comes to investing, most people don't invest enough (if at all) for their future. There are many reasons for this; they don't understand investments, they think they're not rich enough, it’s too time consuming, or feels too complicated and is ‘just too much work’. The study found that almost three quarters of people in the UK don’t have any investments at all.

And it seems there is little help for those looking to start investing in their future. Another study conducted by the Financial Conduct Authority found that only 6% of 18-34-year-olds received any financial advice in 2017 (1). This ‘advice gap’ means that most people are not receiving enough help to plan for their financial futures. What’s more, a 2017 study by Schroders found that half of all Individual Financial Advisors turned away potential clients with less than £50,000 to invest (2). Without much help, complex financial product structures and a lack of transparency around pricing still leave a large part of the population without much of a sense on how to plan for the longer term.

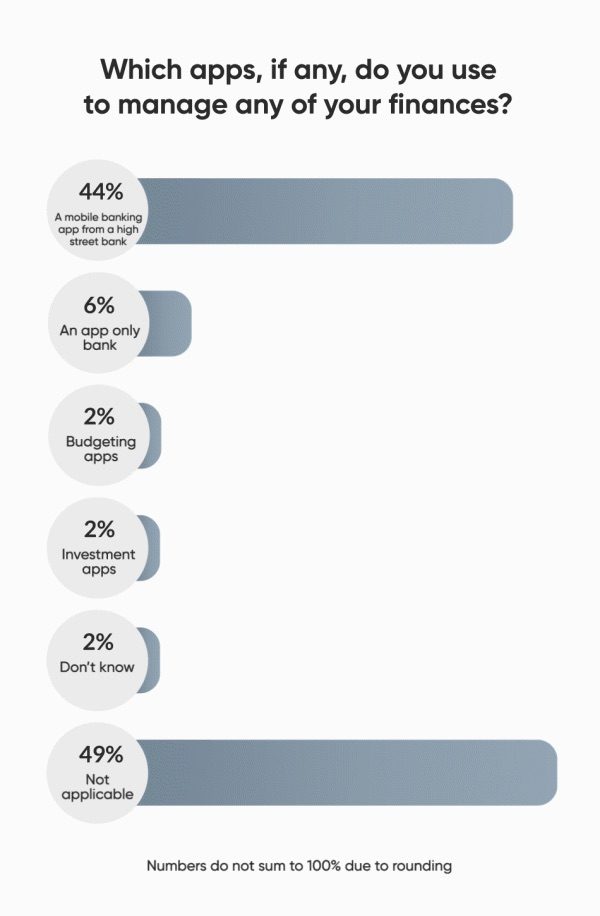

Additional access barriers have arisen over the past few years as well; the YouGov study found that 36% of respondents had been personally affected by bank branch closures. With almost 50% not using any apps to manage their finances, bank branch closures are compounding the financial gap.

Which apps, if any, do you use to manage any of your finances?

Coupled with a stalling economy amidst the ongoing political discussion on Brexit (47% of respondents with a savings account think it will have a negative impact on the value of their savings), most people continue to earn returns on their savings which are lower than inflation, and have little help in planning for their financial futures.

Dozens Founder and CEO, Aritra Chakravarty, said:

“Many fintechs shy away from offering simpler investment journeys to those without prior investment experience because of the regulatory hurdles, leaving customers with little help to plan for their financial futures. Meanwhile the banks that hold the majority of retail consumer money aren’t structured in a way which incentivises them to get customers to invest some of their savings into higher return products which are right for their risk appetite – because most banks earn the bulk of their revenues on mortgages, credit cards and personal loans, any funds moved away from current and saving accounts means a smaller lending book and so less revenue.”

Dozens is looking to help people with managing their finances by providing a simple all-in-one app allowing customers to see their spending, budgeting, saving and investing all in one place. By providing customers with simple, digital access to financial literacy, and opening up sophisticated products previously earmarked for smaller segments of the market, Dozens looks to take people on a journey from spender to saver to investor. It has aligned its business model to how much customers save and invest, rather than relying on their debt or overdrafts for profit. Dozens has also teamed up with Finimize, a financial information app and newsletter targeting millennials, to offer simple guides for money management, and in the future aims to take its services to segments that do not use apps by rethinking branches and distribution models.

Note:

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2077 adults. Fieldwork was undertaken between 15th - 18th February 2019. The survey was carried out online. The figures have been weighted and are representative of all UK adults (aged 18+).

[1] https://www.ft.com/content/1390be10-4404-11e9-b83b-0c525dad548f

[2] https://www.ft.com/content/1390be10-4404-11e9-b83b-0c525dad548f