Our range of investments is now available

We’ve revolutionised the process of investing to make it more straightforward, manageable and fair. So, whether you’re a first-time or long-time investor, our investment shelf could have something for you.

You might have noticed the seedling icon on the bottom right of your Dozens app called ‘Invest’, and if you haven’t ventured over to it yet, there’s never been a better time than right now.

Investing can be a great way of growing your money over the long term, but if you haven’t explored the world of investments before (or have explored but not dived in) it’s easy to be intimidated by the prospect. Even seasoned investors would probably agree that the process of investing can be complex and convoluted; the long questionnaires, challenging suitability criteria and financial jargon create a daunting and disconcerting journey that is probably ‘fine when you know how’, but impossible if you don’t.

While investing isn’t for everyone, the potential benefits of investing shouldn’t be exclusive to the experts, and even the experts shouldn’t have to go through a complex process just because they understand it. We think investing should be easy and accessible – not difficult and discouraging, with complicated requirements and sesquipedalian* language.

So, we’ve revolutionised the process of investing used throughout the market and made it straightforward, uncomplicated and consistent with the revolution of swiping simplicity.

How is Dozens different?

From choosing your investment, to buying it, to keeping track of it over time – we’ve made the whole process simpler and easier, but it isn’t just our process and design that’s different, we also have a unique fee structure. We’re on a mission to make finance fairer, so our platform fee is only charged on the days the value of your portfolio does not close below the invested amount, so just like the rest of our business, we only do well when you do.

How much do I need to invest with Dozens?

You’ll need at least £1,000 to make an initial investment, and you’ll have the option to add to this with monthly contributions (multiples of £100). We set this threshold to ensure that customers only commit to investing when they can really afford to.

The longer you invest, the more likely you are to weather standard market highs and lows. We suggest a minimum of 3-5 years, though you’re free to sell your investment at any time if you need to.

Is investing risky?

It’s important to remember that investing always involves a degree of risk, the main risk being that the value of your investment could fall and you may not get your money back.

We aren’t licensed to give financial advice, so you should speak to an expert if you are unsure about investing. What we can do is offer guidance, which means we can let you know which investments we think could be suitable for your risk level based on the information you give us, and we’ll give you the tools to help you make a decision.

How does it work?

We’ll help you get from saver to investor in five simple steps.

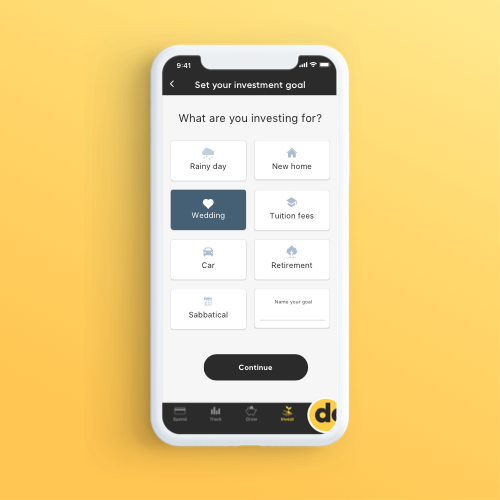

Step One: Set a goal

The first step is to set a goal and target amount that you’d like to reach (in the Invest section of the app).

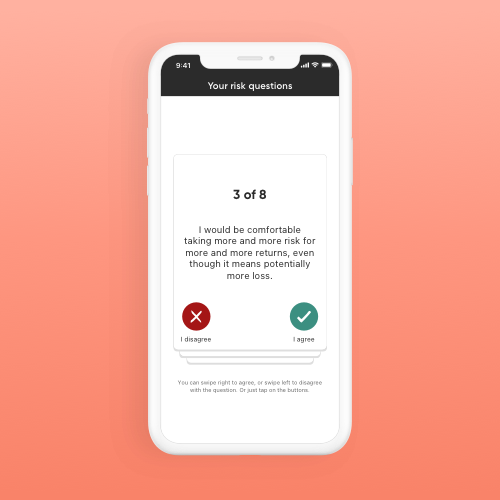

Step Two: Check your risk level

Then we check your risk level by asking you some simple questions. You’ll just have to swipe right or left to answer and this will determine your risk level on a scale from one (very cautious) to five (very adventurous).

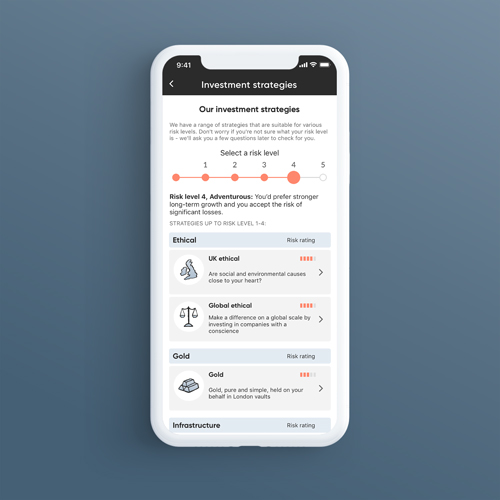

Step Three: View suitable strategies

Then we’ll let you know your risk level and, depending on this, we’ll show you if there are any suitable strategies.

We offer a range of funds from established investment houses like Vanguard and Blackrock.

Many of our investment strategies are themed, so you can choose what to invest in based on your interests. Technology your thing? We have Robotics & Automation and Cyber security ETFs. Clean Energy float your boat? We have that too. Investing in something you have an interest in is a great way to feel more engaged with your investment.

Alternatively, our multi-asset funds are an easy way to start investing because your money is automatically spread across a mixture of shares and bonds in a way that matches your risk appetite.

Step Four: Purchase investment

If, after seeing the options available to you, you decide to proceed, it’s easy to do so. You’ll need an initial investment of at least £1,000 and to chose whether you want to invest within an ISA or not.

Once you submit your investment we will buy shares in your chosen investment strategy on your behalf.

So there you have it. We’ve simplified investing so it’s quick, easy and accessible.

If you’d like to find out more about investing with Dozens, there’s some helpful FAQs here, or you can join in the discussion about our full investment shelf on the community.

If you’d rather head straight to Invest, just open the app and click on ‘Invest’ in the bottom right.

*Sesquipedalian is a word used to describe long words; so sesquipedalian is, in itself, sesquipedalian.

Capital at Risk.

When you invest your money is at risk, as the value of your investment may go up as well as down and you may not get back the amount you originally invested.

Dozens does not provide financial or tax advice of any kind. If you have any questions with respect to financial or tax matters relevant to your interactions with dozens and our investment products, or you are unsure about investing, you should consult a professional adviser.