Our second crowdfunding campaign is live!

Visit the campaign page to invest.

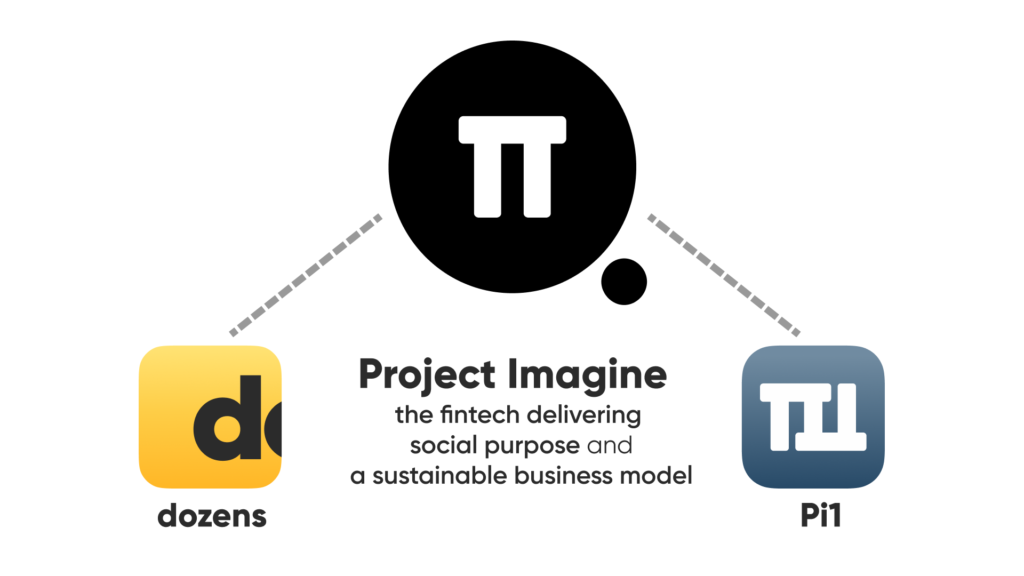

Our crowdfund in 2019 helped us achieve amazing things. It helped Dozens grow from 3,000 to 50,000 customers; it launched our B2B product, Pi1; it led to various awards and a Google case study; it built new financial products, it helped grow our diverse team to 70 strong and even face off the challenges of Covid.

The business is now ready to go to the next level. Read below for more about the business, our history and our plans. And to invest, visit the Seedrs campaign page.

Why crowdfunding?

Crowdfunding can be an effective way to raise money for new businesses, but that isn’t the main reason we choose it as a source of funding. We choose crowdfunding because it fits with one of our fundamental values: financial equitability.

As part of that, we think that anyone should have the opportunity to invest in us, and own their piece of the Project Imagine pie if they wish.

Where we came from.

The companies you trust to look after your money are not in the business of looking after your money.

This is why, in 2018, Aritra Chakravarty left 13 years of banking behind him to set up Project Imagine (PI), the parent company of Dozens.

He brought together a diverse team (that has maintained its diversity even through growth, with a 70% female leadership layer and 50%+ non-financial background), and began making plans for a new kind of finance company.

They wanted to challenge everything that had come before; they wanted to build a financial service that doesn’t profit from short term unsecured debt, but that grows with its customers. And, with customer and business needs aligned, genuinely does everything it can to help them achieve their financial dreams.

In January 2019, Dozens launched to the UK consumer market offering a current account, smart budgeting, saving tools and access to investment products from the likes of Blackrock and Vanguard.

Since last year, Dozens has increased its customer base to 50,000. We gained over 60% of these customers between February to October 2020, despite no marketing spend, demonstrating our strong organic growth. And our cost of acquisition (how much it costs us to bring customers on board) has almost halved to £12.

You can read even more about this on the campaign page.

What makes us different?

- We’re the only fintech startup with a dedicated focus on financial equitability. A focus that is shared by both our B2C brand Dozens and B2B brand Pi1.

- Our socially responsible business model. Unlike others, we will never look to short-term unsecured debt or overdrafts for profit. We’re commercially committed to growing together with our customers.

- We were the first company to hold both an E-money and MiFID licence from the Financial Conduct Authority, allowing us to offer not just a current account and saving tools, but investments too.

- We’re building a self-sustaining ecosystem whereby Pi1 supports the Dozens mission by bringing us to profitability sooner, reducing the requirement for external investment in the future.

- While Dozens works to bring fairness to consumers, Pi1 is bettering the financial services industry.

Pi1.

While Dozens was our first product to launch, it wouldn’t have been possible without the original tech that it’s built on: Pi1, which is now available to the B2B market and helps support the Dozens mission.

Pi1 is a cloud-based core-banking platform that integrates best-in-class fintech solutions into a single API, and comes with an advanced analytics platform. It’s also the reason Dozens will never need to seek profit from debt and the reason Project Imagine is aiming for profitability in the near term.

You can read more about Pi1 on the website, pi1.io, or on the campaign page.

What we’ve achieved so far.

Though we say so ourselves, we’ve accomplished a fair bit since we started. From first getting our licences to being named one of the top ten growth startups at StartUp Grind, it’s been quite the journey. Here’s a quick recap...

- December 2018: Following incorporation in January, Project Imagine obtains E-money and MiFID licences from the FCA, making it the first company to hold both licences in the UK.

- January 2019: Dozens launches in app stores, running on the Pi1 platform.

- September 2019: Dozens partners with Westminster council and opens a pop-up space in Harrow Road, London and also travels the UK to conduct The People's Money Survey.

- November 2019: Pi1 launches publicly.

- July 2020: Pi1 launches card issuing and agency banking services in partnership with Visa, Marqeta and Clearbank.

- October 2020: Pi1 is progressing deals with major incumbent banks and scale-ups in Europe, MENA and APAC.

And we won some awards, too!

- After less than 6 months live, Optima named Dozens 8th Best UK Banking app.

- In 2019, Dozens jumps straight into the Startup100 where we’re named 25th Best Startup across all sectors, and 6th Best Fintech.

- At StartupGrind in San Francisco we’re named one of the Top 10 Growth Startups globally.

- Named as one of the UK’s 'Top 10 Best Banking Apps' by finder.com.

- Google created a case study on Dozens, recognising how we’re helping people understand their spending with a Google Maps integration.

- Recognised alongside Samsung and Apple in the technology section of the Global Brand Awards as the 'Best Innovation in Fintech'.

- Number 9 in the London Tech 50.

- Number 23 in the Top 100 Fintech Disruptors judged by an industry panel and 5000 voters. Ahead of Monzo, Moneybox and Pensionbee on the consumer side, and also ThoughtMachine and 10x on the infrastructure end.

- Saving Innovation award from Finder.

- Most Innovative Socially responsible firm in the Business Elite Awards.

The future.

The vision for Dozens is for it to become the lifelong home for managing your money and planning your financial future. Dozens helps everyone secure the next step in their life, whether that’s going to saving money, buying a house, or retiring.

The vision for Pi1 is to be the first low or no-code core-banking platform of platforms, bringing together diverse fintech innovation from around the world into one common standard for banks and asset managers to integrate with, much like a global B2B ‘App Store’ for finance.

Meanwhile, Project Imagine‘s refreshing take on culture and values ensures we always attract and retain the most driven execution talent to collaborate on bringing these visions to life. This talent pool will also continue to innovate around additional problem statements and brands in the future.

If you’d like to find out and more, or to invest, head to the campaign page.

Please note that investing in crowdfunding raises such as this involves risks, including loss of capital, illiquidity, lack of dividends and dilution, and should only be done once you have completed Seedrs’ onboarding process, and read all the documentation provided on the official crowdfunding webpage, including all the risk warning information. Investments should only be made by investors who understand these risks. Tax treatment depends on individual circumstances and is subject to change in future. This blog is not an investment recommendation to you and any investment decision should be made on the basis of the full campaign on Seedrs’ website.

Seedrs Limited is authorised and regulated by the Financial Conduct Authority (FRN 550317) and is registered in England and Wales with registered office at Churchill House, 142-146 Old Street, London, EC1V 9BW.