Save money automatically | A Guide to Dozens

Wouldn’t it be amazing if saving could just happen without you having to think about it? If the pennies took care of the pounds, the pounds took care of themselves and you didn’t have to take care of anything? We think there’s a way to make saving that effortless – in fact, we think there’s a few.

The old way of saving, of popping pounds in a jar or splitting up your paycheck, is dull and laborious, and is never going to be able to compete with the instant gratification of online shopping

We developed auto savings to try and improve this saving situation, and make saving easy, sustainable and a little more fun, too.

We find taking the boredom out and the pressure off saving helps us build better financial behaviours, which can help us grow our money.

We have three ways of saving automatically:

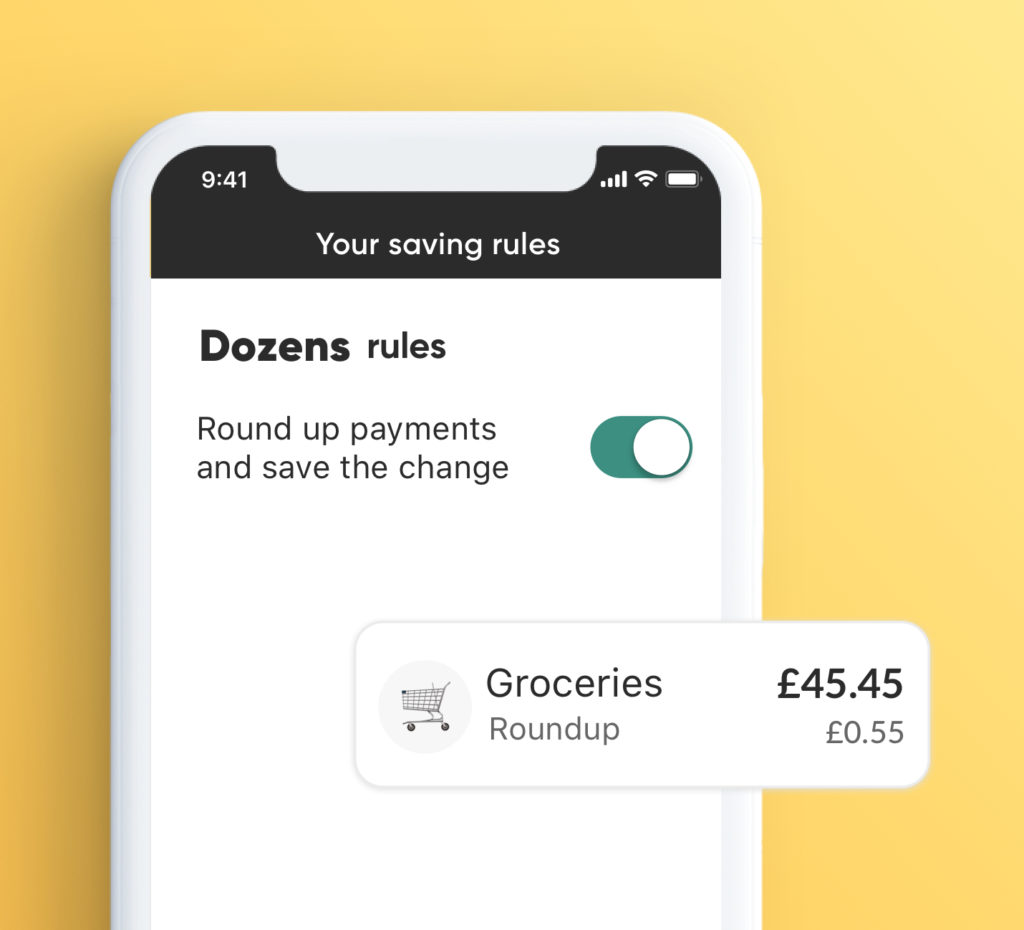

Roundups

The Dozens app can save on your behalf by rounding up your transactions and putting aside the change.

For example, if you spend £2.60 on a coffee, the app will automatically round that figure up to the nearest pound and put the extra 40p into your Cash Savings.

It might not sound like much, but you’ll be surprised how quickly those pennies add up when you’re not thinking about them.

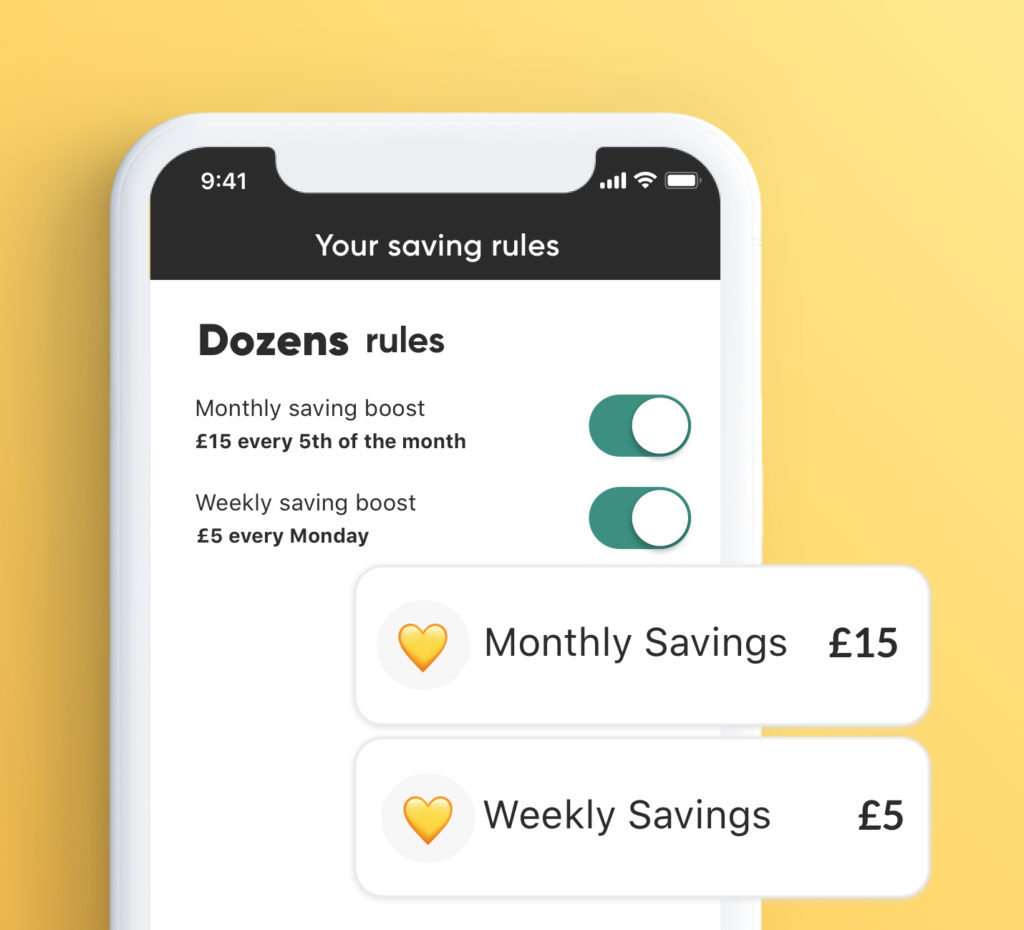

Regular Savings

These regular saving rules are super simple and give your savings a bit of a boost at the end of the week or month.

You just select weekly or monthly, and then the amount, i.e. £5 a week or £15 a month

Then on the date you’ve set, this amount will transfer from your Dozens Current account into your Dozens Cash Savings.

Out of sight, out of mind. Simple.

It’s a great way to ensure you’re saving regularly.

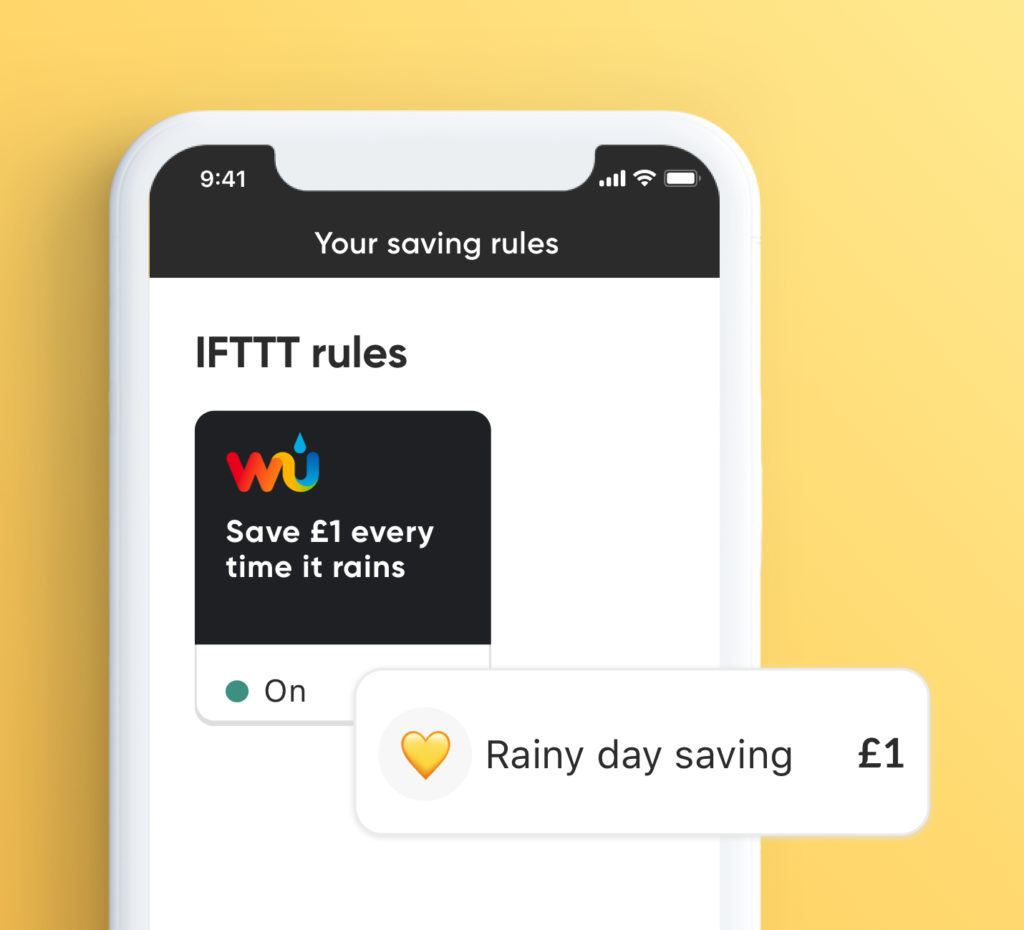

IFTTT rules

‘If This, Then That’ rules are an innovative way to bring fun and motivation into saving.

You can set up all kinds of unique rules, from ‘Save £1 every time Ryan Reynolds tweets’ to ‘Save £100 every time I reach my step goal on my Fitbit’, so you can tailor your saving to suit your lifestyle.

You can use these as rewards (‘save £2 every time I visit the gym’) or repercussions (‘tax £20 into my savings when I get an Uber’) or just things you know will happen often (‘Save £1 every time it rains in London’) so that your savings start stacking up.

These rules are still automatic, so no manual shifting of money into jars or accounts is needed. They encourage you to engage with your money and can incentivise you to live your best life, too.

To enable these rules we’ve partnered with IFTTT – a service that uses ‘applets’ to connect different areas of your life, i.e. your Spotify and your Dozens account. This only ever happens with your explicit permission and the third party has absolutely no access to your banking data – they’re only acting as a ‘trigger’

Auto savings are a great way to make saving a regular part of your life, without having to put too much effort into it. They can be set up in the Grow section of the app.

Which is your favourite?

Don’t have a Dozens account yet? Download the app from the App Store.