Dozens will be closing – Why it’s time to close shop on our inaugural app

We’ve taken the decision to close Dozens, the first brand to have come to life under Project Imagine.

Firstly, we want to reassure all our customers that your money is completely safe. As per usual, all funds are kept in segregated accounts and services will be up and running for the next two months.

At some point during the next two months, we will need you to make arrangements to transfer your money to an alternative account but there is no immediate rush. You will have received direct instructions via email and we are on hand for anything you need. Step by step guides on how to transfer your money are here.

Our current shareholders continue to support the business today, throughout this transition time and the plans for the future. Project Imagine is continuing, but simply changing track to B2B for the time being, to give the long term mission the best chance of success.

Secondly, we want to explain why, putting all factors into consideration, closing Dozens is the right thing to do

2019–today

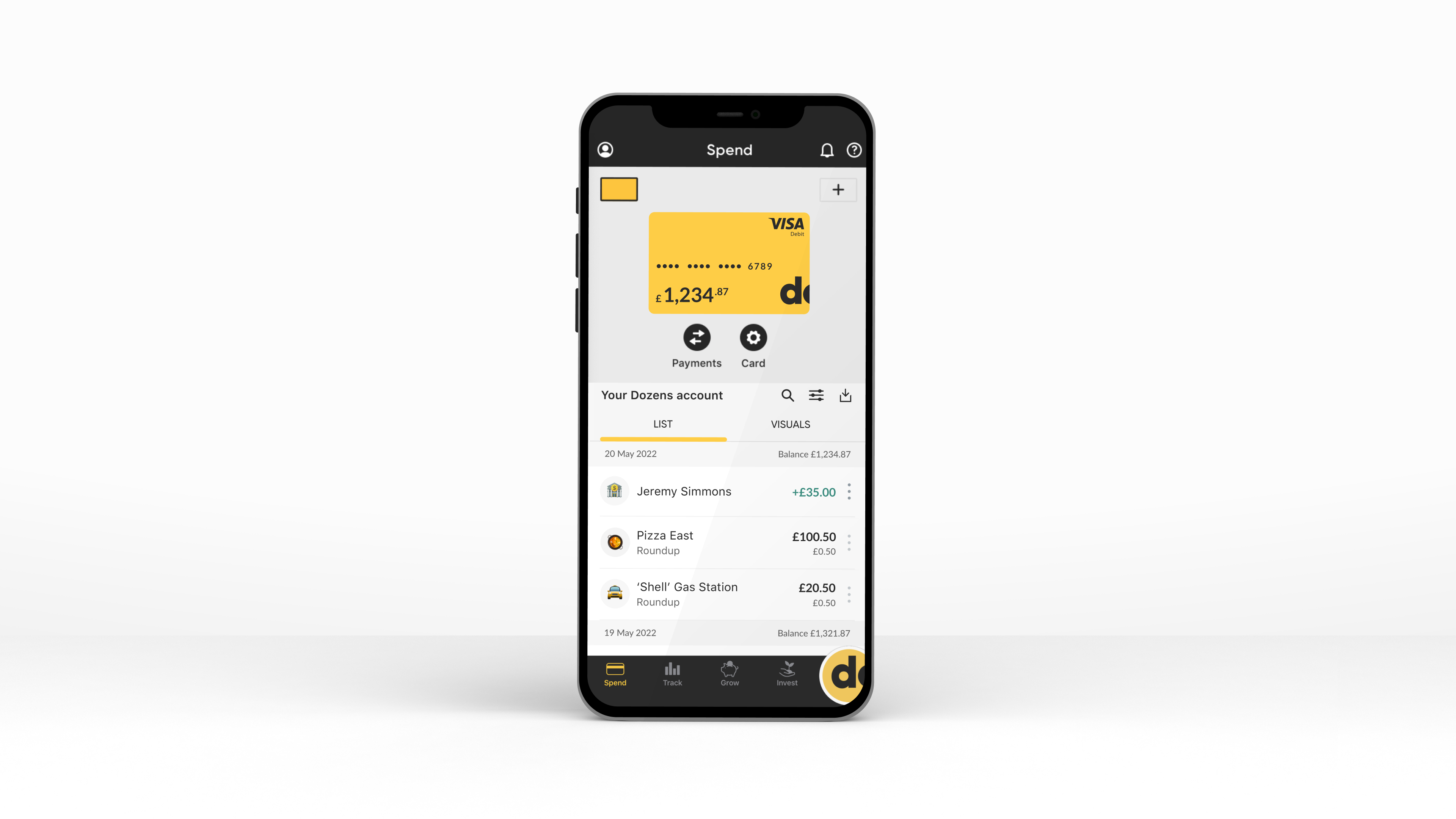

Dozens has had quite a ride since we first pushed the button on the app store launch back in early 2019. Dozens was the first to use both an E-money and MiFID licence to offer spending, saving and investing all in one place. Within a few months we’d manufactured and launched our own financial products – the 5% p.a. fixed interest bonds (at a time when no one younger than 30 had experience of earning interest more than 0.5% from capital-protected products). And by the end of the year we had 25,000 customers, and were experiencing such high growth through word-of-mouth alone that we were able to turn off marketing, and grow steadily to the c.60,000 KYCs we have today.

Little did we know, a once-in-a-century global pandemic was around the corner. Covid hit when we were still a very early stage company. Overnight we lost both investment and B2B deals worth millions of pounds. Our focus immediately switched to survival mode – simply looking after our employees and customers for as long as we could to provide some form of stability at a time when everything was so uncertain.

Somehow we made it through 2020, then 2021, and are relatively proud of what we were able to get done in the time and circumstances we had. Through the summer of 2020 as the world grappled with new realities including forced remote working, we successfully navigated the Wirecard crisis achieving a new bar on customer comms transparency. We then went on to launch Apple Pay and Google Pay, Direct Debits and standing orders, while migrating many of our services over to a brand new petabyte-scale tech stack and new partners like ClearBank, Marqeta and Visa for scalability. We welcomed new members to the team, experimented with team structures and created new internal products to help our operations. We applied our low risk appetites to important day-to-day issues like Anti-Money-Laundering and fraud, resulting in an industry leading, almost-nil fraud rate. By always being super cost-conscious and running the entire operation with less than 30 staff, we also figured out the right cost-to-serve for a new-age digital banking and investments operation while staying open to omni-channel needs through IRL experiments. During this period we successfully raised c.£28m, primarily from our institutional sponsors in Hong Kong, but also c.£1m each from Seedrs and HMT’s Future Fund. We did this while pushing the boundaries on cultural tenets such as achieving ‘no-cv’ hiring, individual salary transparency across the organisation and positive gender pay gap without resorting to quotas.

However, we are now half way through 2022 and the world has changed significantly from the one we launched into in 2019 and the business needs to adapt accordingly.

The world today, June 2022

The domino effect of Covid means there is less money in the system. Covid has led to supply chain disruption across the world and in the UK this has been compounded further by Brexit. The war in Ukraine has reduced supply further in an already constricted system. This lack of movement and supply of goods has caused prices to rise. As people and businesses across all sectors of society are adjusting how they use their money and where it sits, less and less money is being placed in illiquid investments like VC funds.

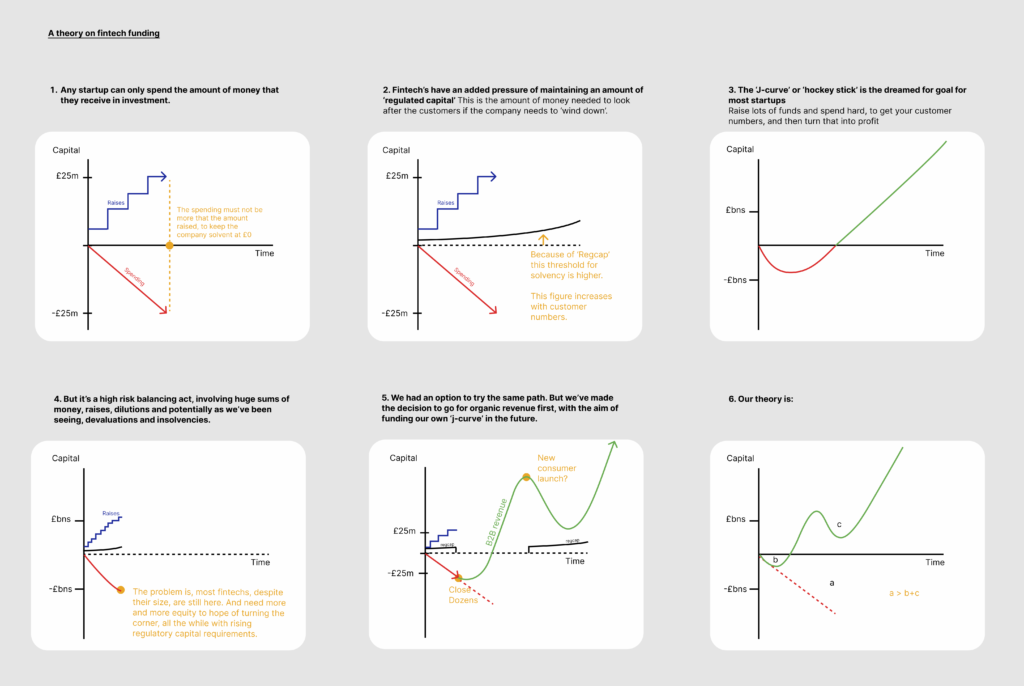

Within the fintech sector specifically, less money is going into the consumer side of fintech. There was a boom in consumer fintech funding in 2014-16, but most of Dozens’ larger, older competitors are yet to convert that into truly profitable businesses, so new funding has been focusing more on the B2B side.

Borrowing is going to go up. It’s a great time to be a bank. But while we’re still in the developmental stages of the business and running on an e-money licence, a model which doesn’t rely on lending has less chance of survival. There is money out there for startups like us to introduce ‘buy-now-pay-later (BNPL)’ and flexible overdraft type products, and you will continue to see these popping up in many places. But for us as a business, and what we set out to do, it’s not a route we are willing to take. We are here to develop a successful new banking business model, not seek success at cost to our customer (the same reason why despite having the licences and the platform capabilities to do so, we never enabled crypto trading for our customers).

Post Dozens – What the change will help us do

As a team, our mission has not changed. We’ve added co-founders along the way and at some point in the future, we still aim to launch a bank, on a full banking licence that doesn’t rely on unsecured personal debt for profit and returns much higher interest rates to its customers. While that is not going to happen in the near future, and indeed given the tall order may never happen, the hard decisions we are making now are helping lay some solid foundations to realise these ambitions.

1. Closing Dozens and reducing operational cost will help us immediately carve out more space for technological innovation

As a business, we are supported by regular monthly funding from our investors. Any responsible business that takes on external funding needs to ensure they’re producing maximum positive impact for customers, employees and investors.

Unfortunately the high operational costs of running a twice regulated business means that the majority of our resources go into day-to-day operations, with little left for financial and technological innovation. This, quite simply, isn’t what we set out to do, or what people need.

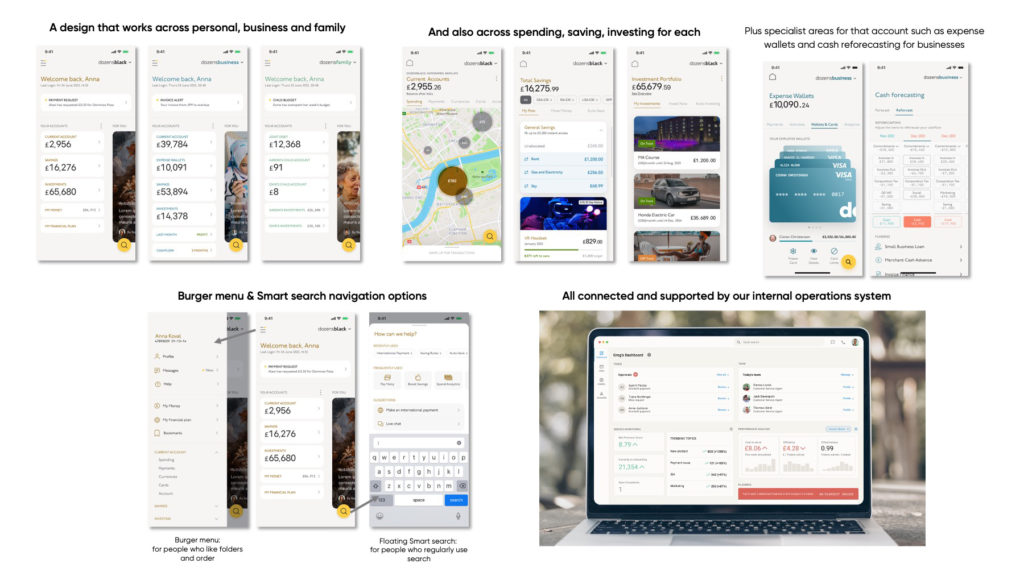

By closing Dozens, more funds and management mindspace can be immediately invested into executing ambitious designs (such as a cryptographic back-end, and new front-ends for individuals, businesses, families and internal ops teams) on the tech platform.

2. By focusing on B2B for a period, we will be building a self-sufficient business

Any responsible business that takes on external funding also needs to ensure they are securing revenue, not just external investment. Otherwise losses are scaled and the business can end up in a spiral of debt. As business owners this isn’t a path we’re willing to take.

We hold a strong stance on venture funded marketing, i.e. investors ploughing money into a business to increase customer numbers at all costs, without considering positive unit economics and average balances. Our approach is noticeably different to the grow-first, cross-sell-later model that most have adopted so far. But it is our belief that visible top-line growth, funded by continuous dilution, without work on relatively more invisible cost and revenue controls is a risk to any business, and its mission. Ultimately those losses have to be made up somehow – at the expense of the customer (usually through offering unsecured, high-margin personal lending products such as BNPL) or by resorting to new investors and delayed IPOs.

We know that to have any chance of achieving our long term mission, we need to be self-sufficient via organic capital generation from our own revenue lines and profit centres.

3. A lot of value has been created in running Dozens and working with our customers over the past 3.5 years. This will help propel us to the future.

Any banking service has four main costs – technology, operations, real estate and credit losses. Real estate is typically less of a concern for digital businesses and credit is one area we haven’t experimented in. But we do have an incredibly good hold on cost control in technology and operations, and have even built our own internal product to help with this and operational compliance.

So as well as our banking technology and tools to help internal cost control, we have also developed the best team structures, refined target cost-income ratios and customer loadings, and built a positive relationship with the regulator as we tried out new financial products and developed new ways to fight financial crime.

By making this technology and insight available to established banks in need of new architectural models, we have a chance of securing long term, sustainable revenue for Project Imagine.