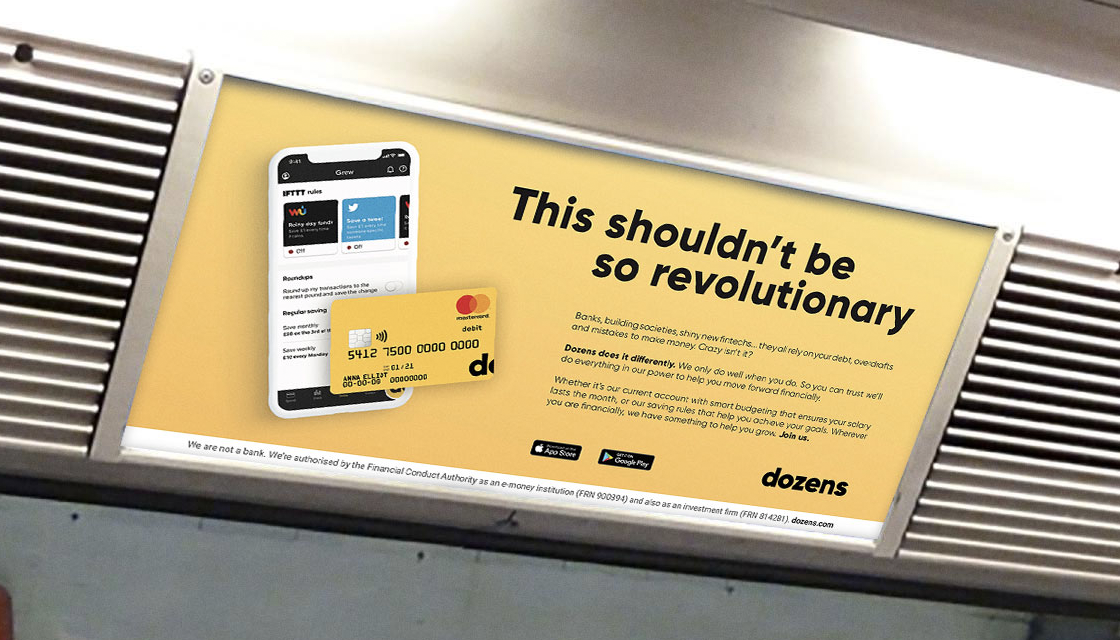

This shouldn’t be so revolutionary

Seen our ads and wondering what we’re all about? Read on and find out why 18,000 people (and counting) have joined Dozens.

A financial service that doesn’t rely on your debt. A business model based on ‘the right thing’. A company whose profit is directly connected to the wellbeing of its customers... Surely this is the way things should always be done?

We didn’t set out to launch a startup. Not many of us working at Dozens come from the ‘startup world’, or even the world of finance. Instead, we come from a variety of industries; there's the urban designer, the psychotherapist, the community leader, the lawyer… very few of us ever imagined challenging the financial industry, even those who had decades of experience working in it.

But we did all have experience of a system that wasn’t working for us.

We were scattered across the financial spectrum – some of us were struggling with large amounts of debt, others had a wide portfolio of investments, most were somewhere in between. All of us were being held back by an industry that wasn’t helping us progress, leaving us at best indifferent and at worst seriously stressed.

So, what is holding us back? Is contactless making us less engaged with our money? Has the financial crisis left us with our fingers burnt and we’re relieved if things are ‘just okay’? Have incredibly low interest rates led to a generation with little hope for any organic growth of their money? It’s likely that all of the above are having a negative effect, but none so much as the crux of the issue:

The companies you trust to look after your money,

are not in the business of looking after your money.

When industry thrives on your struggle.

You’d think that ten years on from the financial crisis, after changes in regulation and a surge of ‘fintechs’ all claiming to offer something new to the industry, financial services would be fresh and revitalised. Behind the ad campaigns and shiny surfaces, though, little has changed.

Whatever the shape of the institution, bank, building society, fintech – the business model has remained unchanged for hundreds of years: lend money to make a profit.

It makes sense then that whenever you go into a branch or open an app, your financial service provider is waiting for the moment you run out of money, and then… up pops the offer of a loan, secured with little more than a swipe. Banks rely on loans and overdrafts for income. So even though some of these products have incredibly high rates and are a very poor option for a customer, the business model dictates that they are a product that needs to be pushed, so these products are made exceptionally accessible, and it’s easy to then get stuck in a circle of debt.

So what does it mean when the financial industry’s needs are at odds with those of its customers?

It means investing in technology to help you spend quicker, like contactless and online payments, rather than technology to help you save or invest. It means using your data, not to help you, but to work out when you might want a loan or an overdraft.

However, this isn’t only the case in finance, it’s endemic across a multitude of industries; social media companies are a prime example of what happens when business’ interests don’t match those of the customer. They make their money advertising among content that drives communities apart, how can they convince their profit-seeking shareholders to regulate or remove that content when it makes money? Likewise in financial services – how are companies going to convince their shareholders to invest in helping their customers save and grow, when they benefit more from their debt?

This misalignment of interests is the root cause of so many problems across industries, but we feel it most in finance. So we’re working to challenge the belief that things can’t be done differently. Which brings us to Dozens – the first financial service that only does well when its customers do.

Of course, since we're a business we do need to make money in order to pay our staff, provide a great service to our customers and allow our shareholders to make a return – but we don’t disadvantage our customers to do it. We make profit through a small percentage from our partners and financial products across the platform. But, as our income comes from things that help you do well and not from you falling into debt, everyone works to help you succeed, because that’s what helps us succeed too. Our business model doesn’t rely on kindness or special ‘social responsibility’ programmes. The ’right thing’ is woven into the fabric of the business, as we believe it should be.

We do not simply want to become another ‘online banking app’, we do not want to become a tech platform, and we do not want to become a robo advisor. We want to create a company that revolutionises the finance industry by truly putting our customers’ interests at the heart of it, and this shouldn’t be so revolutionary.

So how has this socially responsible business model influenced the services we’ve built? Read more.