How does a socially responsible business model inspire the services we provide?

A financial service that doesn’t rely on your debt… A business model based on ‘the right thing’... A company whose profit is directly connected to the wellbeing of its customers…

What does this actually mean for the services, the app and for you?

You may have heard or read about Dozens’ socially responsible business model. Read on to find out what this means in practice and how we work to make sure Dozens is the account that helps everyone move forward financially.

We built Dozens with the whole of the UK in mind.

To make sure we were getting a wide range of perspectives and could create something that would be useful to all financial situations, we worked with a community of over 300 people across the UK from different financial backgrounds to develop ideas and design the app. So whether you’re a student managing a term-long budget, or an investor looking for the best place to easily manage your money, we’ve have something for you. This approach has helped us to grow to almost 20,000 customers in our first nine months, and we continually engage with our customers to make sure we’re offering something that can be used by everyone, whatever their financial situation.

Dozens allows you to manage all your money in one place.

We’ve found that too often people have money spread across different financial institutions and apps. The issue with this is that it’s so easy to lose track of our money – it makes budgeting harder and, quite often, money sits there gathering dust rather than interest, as rates drop and you don’t notice (because who has time to keep checking their interest rate?!). This is why we’ve built something that allows you to manage all your money in one place; a current account, everyday saving tools and an investment provider – all in one app.

Dozens helps you understand your spending.

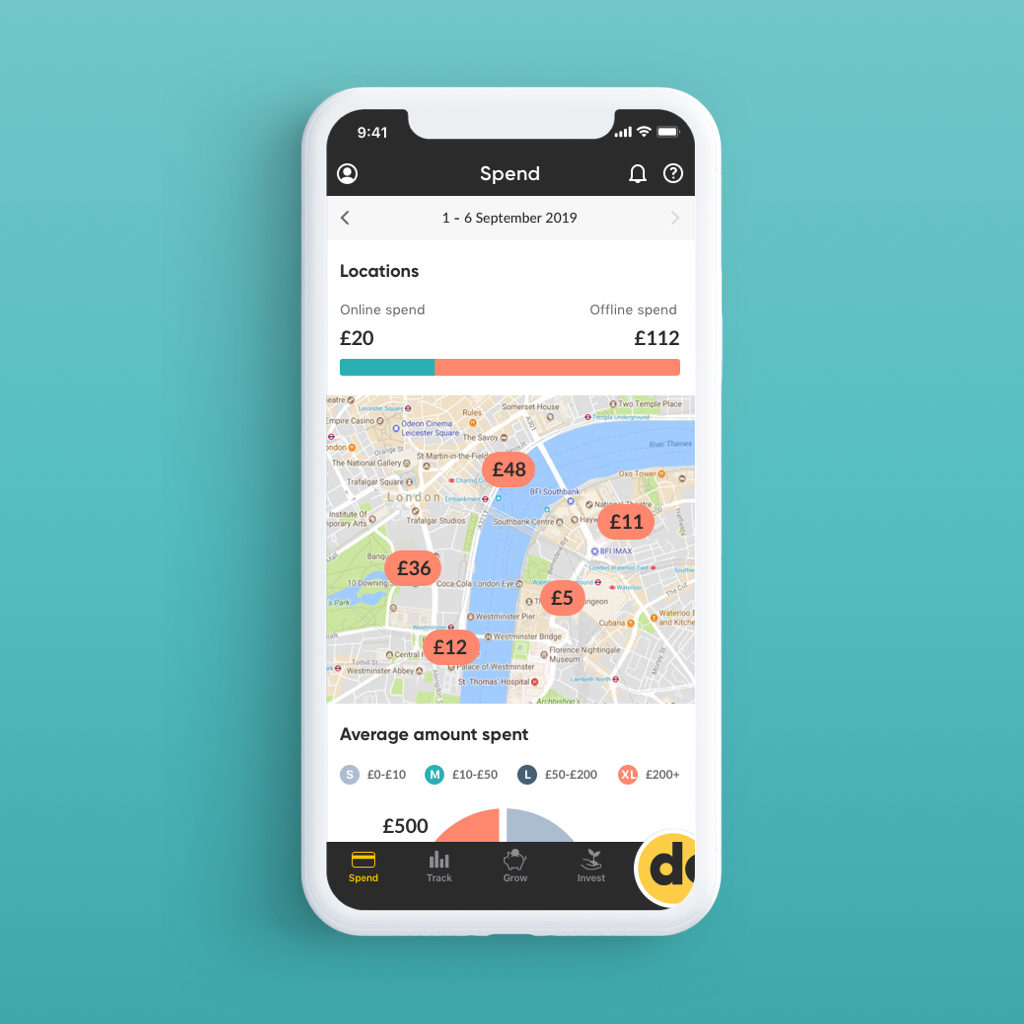

Whenever you spend with your Dozens Visa debit card, we use visualisations to help you understand your spending and consider changes you might make in the future. In this way your data – that is readily available to any card provider – is being used for your benefit, rather than to sell you something.

For example, as well as the usual transaction list, we show a range of visuals about your spending – how much you’ve spent online vs offline, the size of your purchases and even how the purchases made you feel.

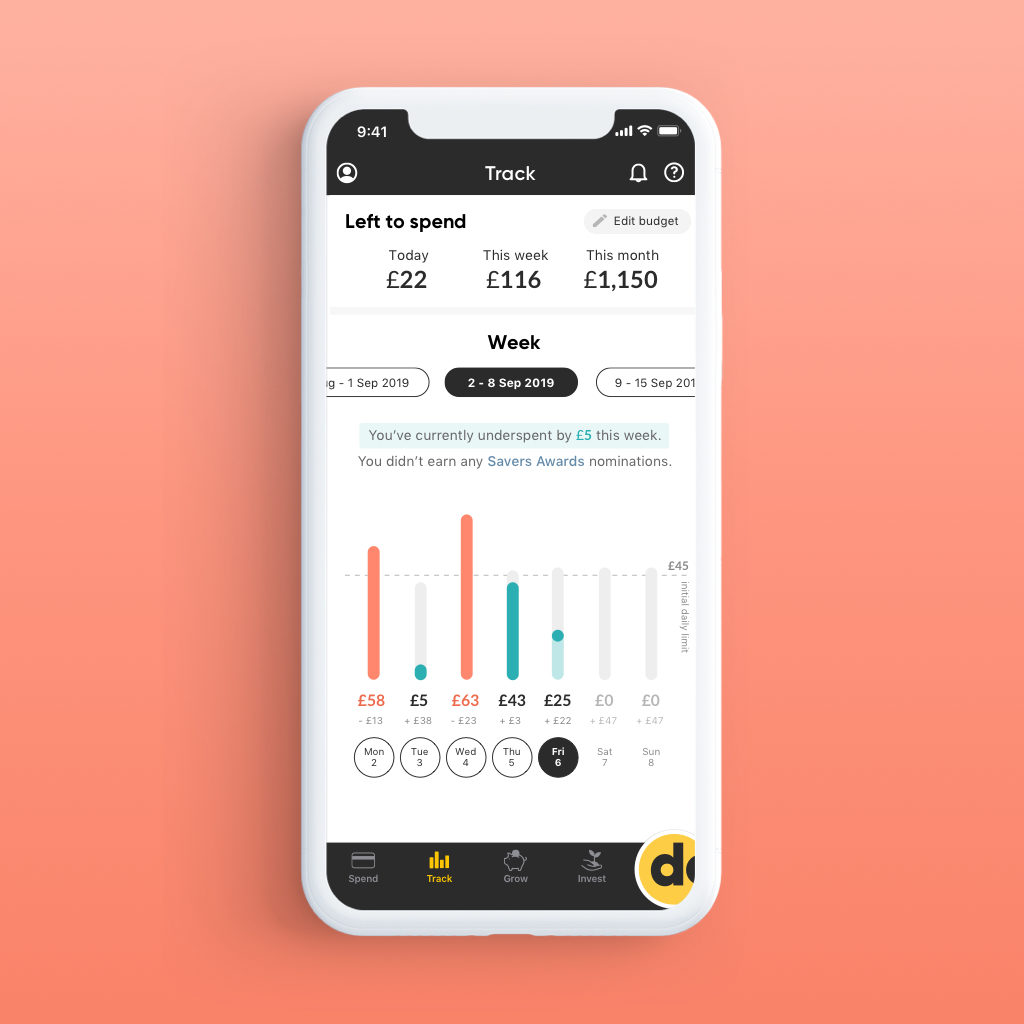

Dozens helps you budget across the month (or term).

Overdrafts are incredibly poor value for a customer, but they're often cleverly priced to make the impact seem small so you don’t worry too much if you slip into it and don’t quickly scramble to get out, but these slips can add up. In order to help people manage their money better, we knew we needed to break the habit of slipping into debt at the end of the month. We created smart budgeting to ensure you don’t need an overdraft. The tool is like no other as it takes into account all your income and outgoings, and adapts your daily budget if you’ve spent more or less than intended so far that week to help you stay on track.

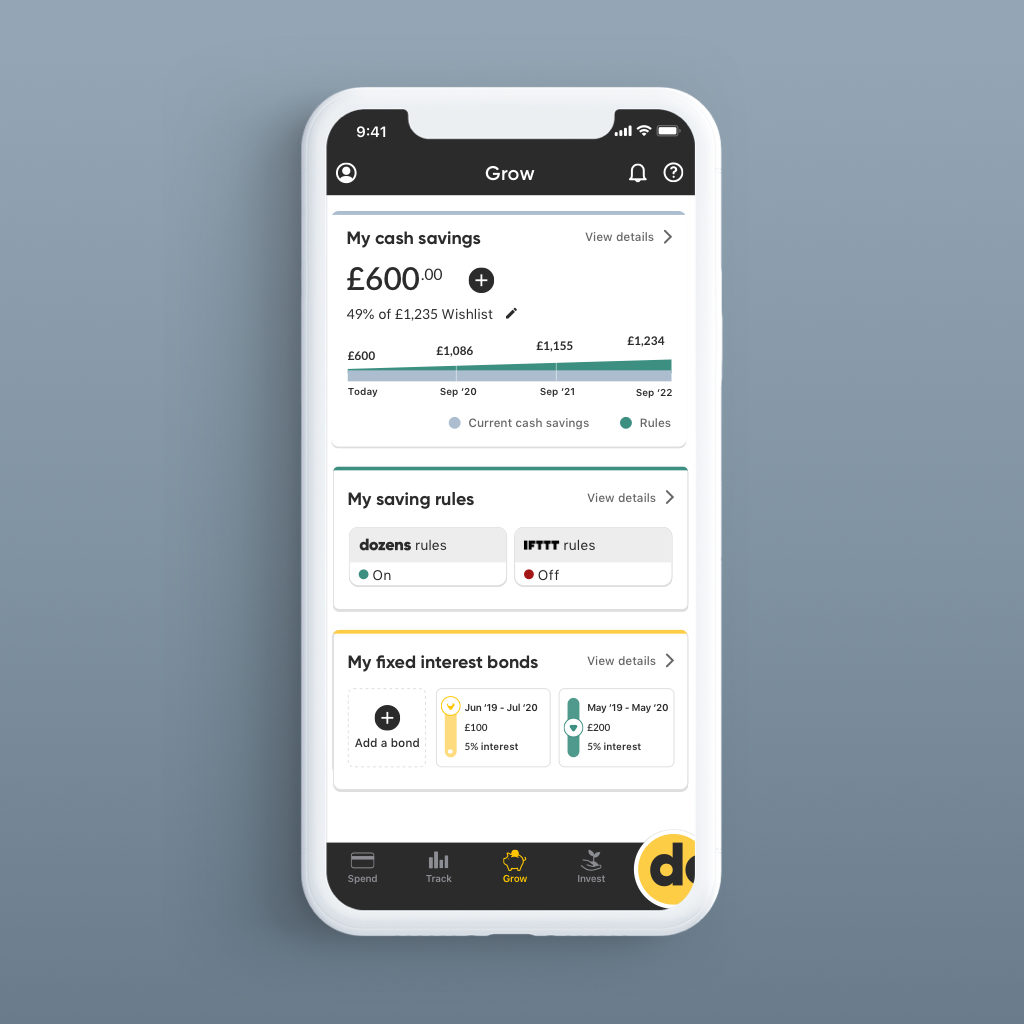

Dozens makes saving… just happen.

What if saving just happened? What if it wasn't a chore or something you had to remember, but was built into your everyday life? With Dozens, money automatically moves from your current account into your cash savings because, well, maybe you’ve just been paid, or you turned the heating down, or maybe just because your favourite celebrity tweeted?

We’ve found through our research that many people wait until the end of the month, and just save however much is leftover… which means that some months, there’ll be nothing to save. With our Saving Rules, saving just happens throughout the month, friction free, and can actually end up being a bit fun!

Dozens rewards good financial behaviour.

Our Savers Awards were designed to encourage and reward positive financial habits. Throughout the month, certain things you do within your Dozens app – the positive financial behaviours – will get you nominations for our Savers Awards. At the end of each month there will be a prize draw where we will give out cash prizes of £100.

Dozens Savings Plc offers 5% p.a. Fixed Interest Bonds

From the beginning, we knew it was important to look at ways people could earn a decent amount of interest, as well as just helping people to budget and save. In our opinion, interest rates on easy access, low risk products have not been ‘decent’ for a very long while, so something new was needed. This is how the 5% p.a. Fixed Interest Bonds were born. These 12 month bonds are designed to give anyone with as little as £100 access to the kind of interest rates normally reserved for people with large chunks of money or high risk appetites. More details on these can be found here.

Dozens has created a fairer, more accessible way to invest

We’ve found that very few people consider investments. Seven in ten people in the UK do not hold investment products, and we think a lot of that could be down to the seemingly daunting process. While investing is not necessarily right for everyone, we want to open it up to a wider audience by making it more accessible. Many people are losing out because there are currently physical and emotional barriers to entry and because of this many people aren’t benefiting from being able to invest.

So we approached this in a few ways. We’ve started by offering investments in the same space as your current account, so it’s easy to manage your money in one place.

We’ve also created a unique risk assessment. This is an important step when purchasing an investment is the risk assessment but it’s often a complicated and intimidating form. We’ve turned it into a simple, swipeable experience making it easier to understand what your risk level is.

Our investments are offered as thematic portfolios, meaning they’re based on topics like ‘Biotech’ and ‘Clean Energy’, so you can select based on your interests or views.

And when you’ve purchased an investment, you’ll receive a fairer fee structure. As part of our commitment to ‘only doing well when you do’, we won’t charge our fee on days where the value of your investment drops below the amount you originally invested.

Dozens – the first financial service that only does well when its customers do.

Join us.

To get a Dozens account, and start experiencing the impact it can have on your money download the app now.

------

Article amended 30 April 2020 - Updated to reflect updated investment licence.

Dozens is not a bank. Dozens is a trading name of Project Imagine Limited which is a company authorised by the Financial Conduct Authority (FCA) as an e-money institution (FRN 900894) and also as an investment firm (FRN 814281).

Bonds are not FCA regulated products, and FSCS protection does not cover the bonds. Dozens’ Fixed Interest Bonds bonds are allocated, issued and administered by Dozens Savings Plc. The interest offered by Dozens’ Fixed Interest Bonds will not fluctuate even in different market conditions. All of your money to be invested, plus the full 12-months interest, will be placed in a separate trustee-controlled account on your behalf. This would be used to pay you in the event of any default. The bond programme currently has a maximum limit of £7m, with expected issuance volumes of between £100k-£1m a month.